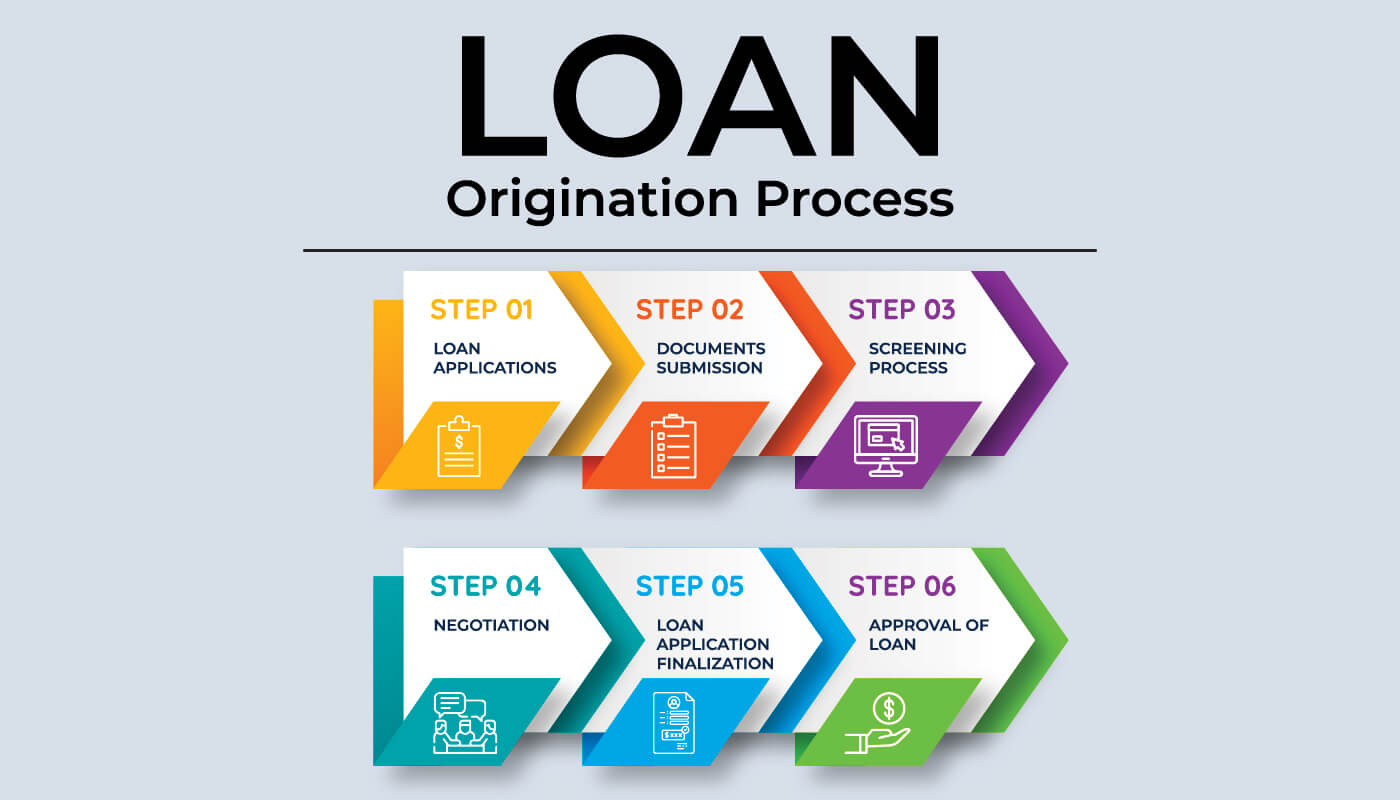

The Mortgage Loan Origination Process

In your MLO online course, you'll delve into the intricate process of mortgage loan origination. This process involves multiple steps, from initial contact with a borrower to the final closing of the loan. A thorough understanding of this process is essential for success in the mortgage industry. Learn more about it here.

The Initial Contact

The first step in the mortgage loan origination process is the initial contact with a potential borrower. This can occur through various channels, such as:

In-person meetings

Phone calls

Email

Online applications

During this initial contact, you'll typically gather some basic information from the borrower, including:

Personal information: Name, address, phone number, and email address

Financial information: Income, assets, and liabilities

Property information: Desired property type, location, and price range

Pre-Approval

Once you have a basic understanding of the borrower's needs, you can begin the pre-approval process. This involves:

Credit check: Pulling the borrower's credit report to assess their creditworthiness.

Income verification: Verifying the borrower's income through tax returns, pay stubs, or bank statements.

Asset verification: Verifying the borrower's assets, such as bank accounts, investments, and real estate.

Issuing a pre-approval letter: Providing the borrower with a pre-approval letter that outlines the loan amount they qualify for.

Loan Application

Once the borrower has found a property, they will complete a formal loan application. This application will require more detailed information, including:

Property information: Property address, purchase price, and property type

Loan details: Loan amount, loan term, and loan type

Financial information: Detailed income, asset, and debt information

Loan Underwriting

The underwriting process involves a thorough review of the loan application to determine the borrower's creditworthiness and the property's value. Underwriters will assess factors such as:

Credit score: A higher credit score typically leads to better interest rates and terms.

Debt-to-income ratio (DTI): This ratio measures the borrower's monthly debt payments relative to their income.

Property appraisal: An appraisal is conducted to determine the property's market value.

Title search: A title search is performed to ensure clear ownership of the property.

Loan Approval or Denial

Based on the underwriting process, the lender will either approve or deny the loan. If the loan is approved, the lender will provide the borrower with a loan commitment letter, which outlines the terms and conditions of the loan.

Closing the Loan

The final step in the mortgage loan origination process is the closing. This involves:

Signing the closing documents: The borrower will sign a variety of documents, including the mortgage note, deed of trust, and closing disclosure.

Disbursing the funds: The lender will disburse the loan funds to the title company or escrow agent.

Recording the mortgage: The mortgage will be recorded at the county recorder's office.

By understanding the intricacies of the mortgage loan origination process, you'll be well-equipped to navigate the complexities of the mortgage industry. Your MLO online course will provide you with the knowledge and skills necessary to excel in this rewarding career.

Comments

Post a Comment